Certificate of Insurance for Moving

What is a certificate of insurance for moving and do you need it?

In major metropolitan areas, before you or your movers can step into your new building, your property manager may require a Certificate of Insurance (COI).

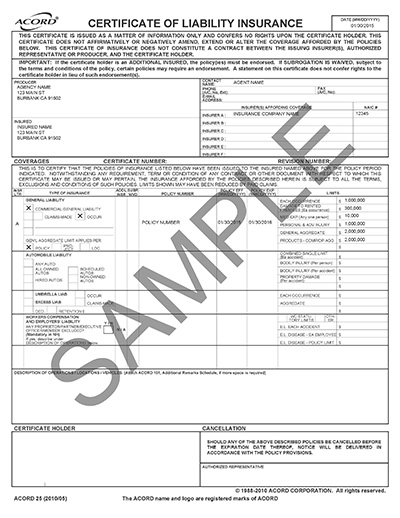

A COI is a document from your moving company that verifies and summarizes their insurance policy. Though most moves go off without a hitch, sometimes accidents happen. A COI gives you and your property manager peace of mind by proving that your movers is properly insured.

Does Everyone Need a Certificate of Insurance to Move?

No. However, you will need to check with your building’s property management to see if a COI is required. Most elevator buildings in NYC need one in order to protect their property. Make sure you mention us that the COI is required when you call to schedule your move.

What’s in a Certificate of Insurance?

There are several pieces of information in the COI that the building manager will want to see. First, it states that the movers are insured. Then it goes into more detail about what is covered and how the certificate should be used. This gives the building manager peace of mind that any damage will be covered by the insurance company.

Want Additional Coverage?

Moving Insurance and Valuation.

It is important to understand how much the movers are responsible for any loss or damage.

Extra coverage is optional that you can consider purchasing from us or third party before the moving process begins.

Understanding valuation and insurance options ⟩

Option A.

Basic Value Protection up to $10,000 in household coverage is free of charge on all moves and is included in the moving rate. We will repair the item, replace it with a similar item or make you a cash settlement for the cost of the repair or the current market replacement value.

Option B.

Replacement Value Coverage, with deductible: We will repair the damage to your satisfaction, pay you for the lost or damaged articles, less the $500 deductible, or replace the lost or damaged article for any amount over the $500 deductible. This level of protection costs $30.00 per $1,000 of your declared value of the entire shipment. A comprehensive inventory list is required, which should include items of extraordinary value like jewelry, silverware, collectibles and digital devices. The minimum of $5,000 declared value is required for this option.

Examples:

$5000 coverage – $150

$7500 coverage – $225

$10000 coverage – $300

$20000 coverage – $600

* Can't be use in case we are loading/unloading your truck, unloading to your storage unit or loading from your storage unit.

Rules and regulations for valuation coverage:

The valuation does not automatically pay for any damage. It must be clearly shown that the mover was responsible.

Our movers are not responsible for: items found broken in boxes not packed by Anton’s Movers. Mechanical condition of electronic, audio/video, computer in transit or storage. Previously damaged or repaired items.

Even if you see damages to items at the time of the move, you are legally responsible to pay the full amount for the move.

Contact

Please contact our office with any questions or concerns.

Anton's Moving Co, Inc.

(617) 319-5700

info@antonsmovers.com